|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

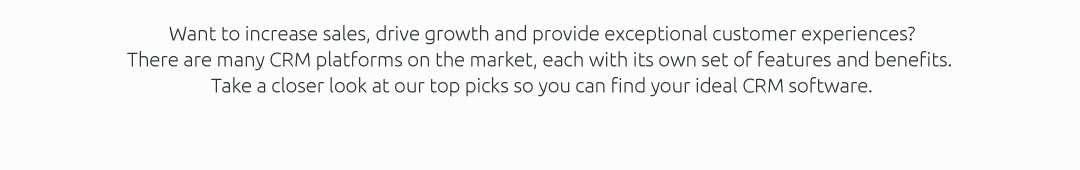

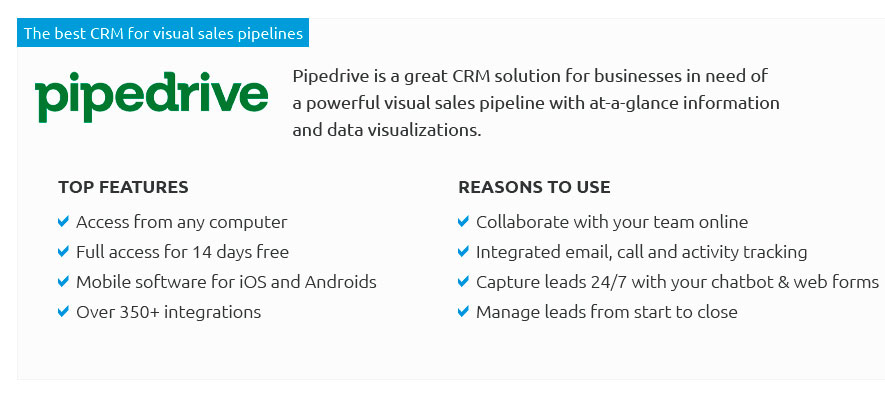

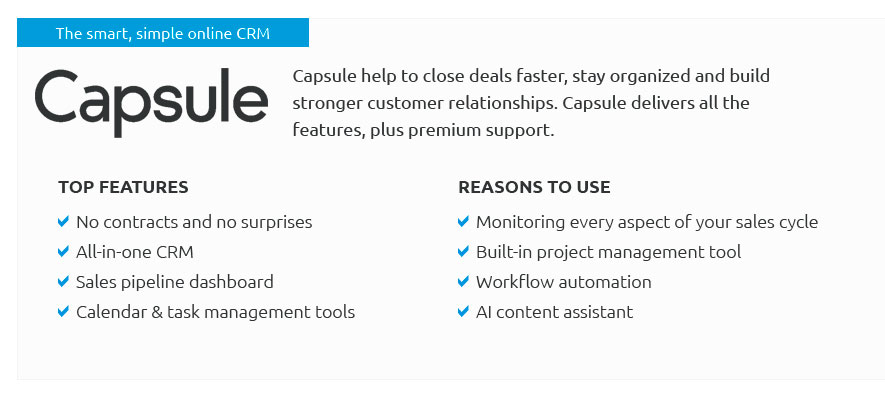

hwdjyrr4k Discover the ultimate CRM software review that cuts through the noise to reveal the best CRM platforms tailored for investment managers, where innovation meets precision; whether you’re seeking to streamline client interactions, enhance portfolio management, or harness data-driven insights, our expertly curated list spotlights the crème de la crème of CRM solutions that empower you to elevate your client relationships and investment strategies to unparalleled heights, ensuring you stay ahead in the competitive financial landscape with tools that are as dynamic and ambitious as your goals.

https://www.affinity.co/blog/investor-relationship-management-software

Investor relations CRM (or IR CRM) is software that helps firms manage relationships with current and prospective investors in their funds. It centralizes ... https://www.dakota.com/resources/blog/crm-buying-guide-2024-for-investment-firms

Salesforce is one of the most widely-recognized CRM options available, originally created for the investment management industry in 1999. Today, the CRM is ... https://community.dynamics.com/blogs/post/?postid=34cfbb09-c918-44bf-8fa5-b8659d5554c1

The relationship management aspects of the system should allow fund managers to identity potential investments against investors and funds. Reporting these ...

|